ARTICLE: Why Ammeris goes PoW for main-net

- By Erik Fertsman

- •

- 17 Sep, 2018

- •

It doesn't boast high performance, because it doesn't need to.

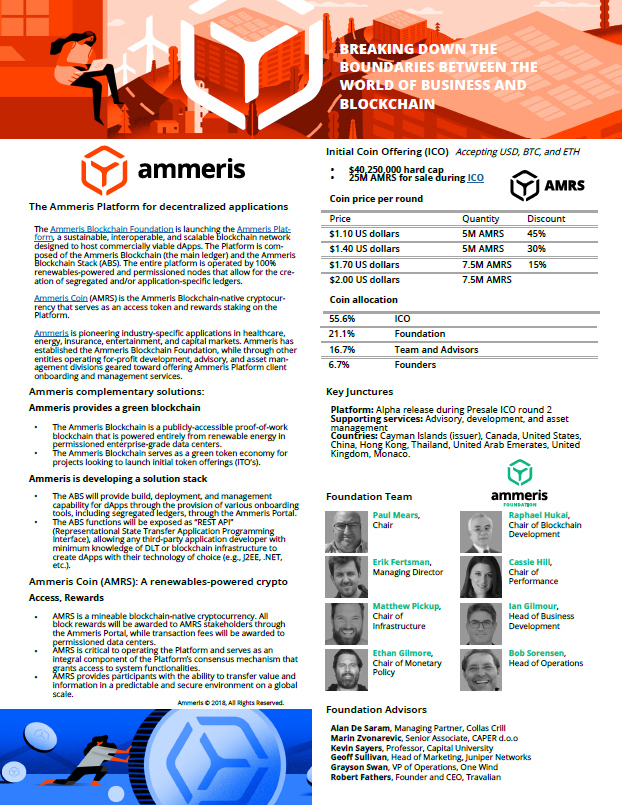

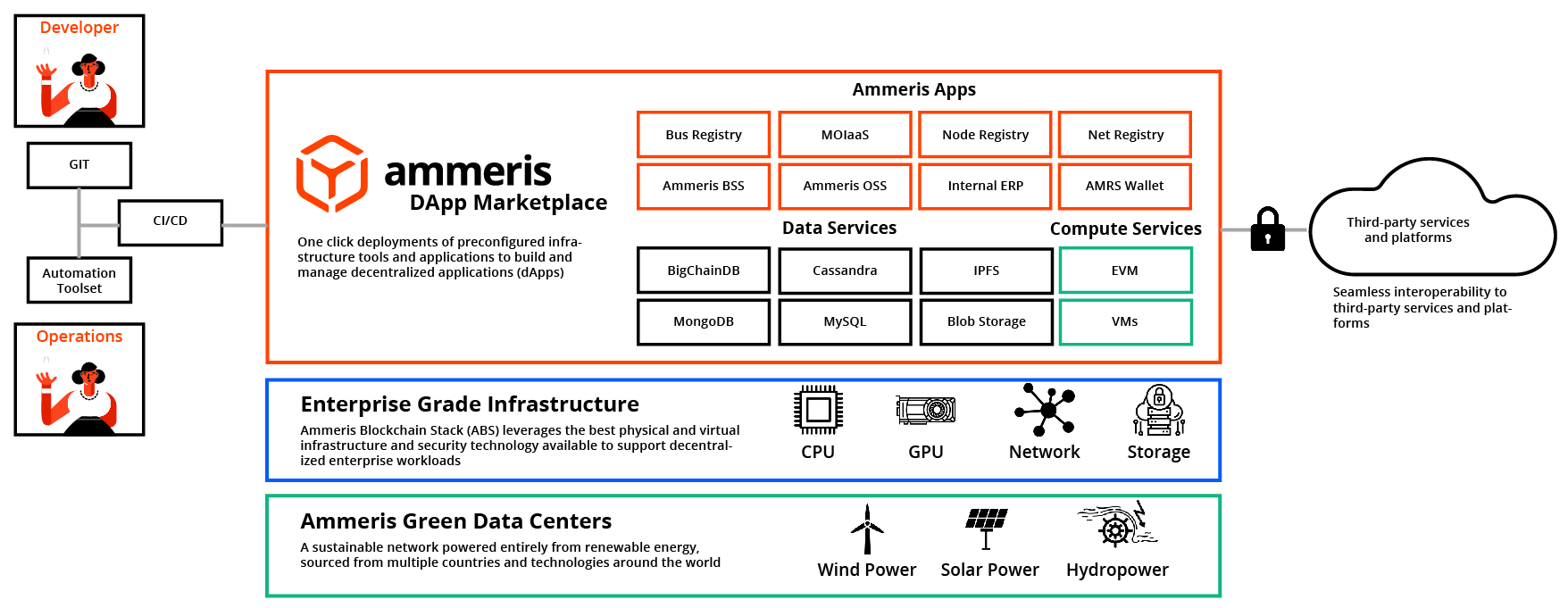

Later this year, Ammeris is delighted to be launching a green-powered blockchain as part of the wider Ammeris Platform. This ledger (the Ammeris Blockchain) is meant to serve as the first iteration of Ammeris’ solution-stack and will act as a general-purpose database to support various smart contracts and decentralized applications (dApps) through Ammeris’ public marketplace. The ledger uses the ethash “proof-of-work” (PoW) code, but is permissioned for hosting purposes as it aims to achieve sustainability goals.

I’d now like to take a moment to clarify why we have gone with PoW for the Ammeris Blockchain and how this ledger serves both as an integral economic function by introducing a renewables-backed cryptocurrency, and a utility component by providing capital markets infrastructure for the overall solution being built by both Ammeris and our partners.

*For more info about Ammeris’ technology, including the solution-stack, please visit www.ammeris.com/blockchain. The discussion here does not purport to be a complete listing of the facts and ideas. The Foundation is set to publish the Permissioned Node enrollment program later this year at www.ammeris.com/foundation, which will allow data centers around the world that are powered entirely by renewable energy to host the Ammeris Platform.Big steps for blockchain

The launch of the Ammeris Platform is an evolutionary, but massive step for us as an organization that is incubating and working on various projects that are developing blockchain and crypto-related businesses. At our core, we became frustrated with many of the challenges of developing commercially viable businesses in the crypto and blockchain space, so we decided to launch our own infrastructure platform and tokenize it (see Ammeris whitepaper, section 2 and 3 for detailed explanation). To further illustrate the source of this frustration, it’s worth noting that the latest figures on Ethereum show only 6 applications with more than 300 users, while more centralized platforms like EOS - which boasts a high transaction throughput for millions of users - in reality hosts only 2 applications with more than 300 users. Blockchains today lack adoption and real users. In large part this is because they are simply not conducive to hosting applications.

In response to this environment, Ammeris is pushing a public solution that takes existing knowledge, open-source technologies, and custom code, and stirs them together to create an alternative tokenized platform geared toward breaking down the boundaries between the world of business and blockchain. We're gearing up to host real-world business that is set to easily break the Ethereum and EOS figures cited above, combined. Where our approach is different from others, is that we provide a solution that offers scalability and interoperability through segregated or partitioned ledgers accessible via API. We're also technology-agnostic, so expect to see the green platform grow alongside your favorite code.

This all boils down to the fact that developers will no longer need to worry about the nuances of their database configurations, or whether their digital assets or data will become trapped on a platform destined for abandonment or forking. Gone are the days when a project with a single ledger attempts to serve the complexity of commerce.

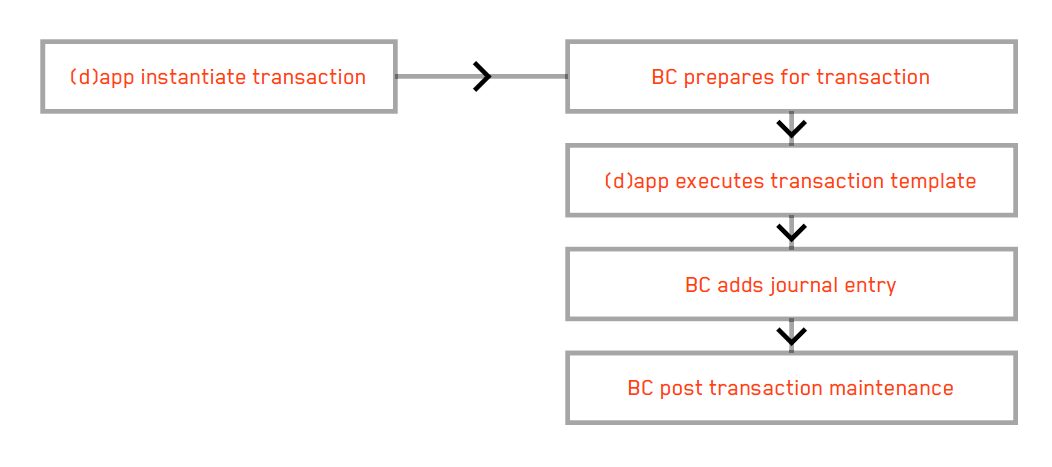

This is where the Ammeris Blockchain comes into play. To support our offering, Ammeris is launching a “main-net” based on the PoW ethash source code that does not boast high transaction throughput (although it will be configured for better performance when the time is right), nor does it possess the capacity to compartmentalize data; it doesn't need to as the wider platform will offer features that take care of those requirements. Instead, the ledger simply serves base needs such as:

- a publicly-accessible database for the deployment of smart contracts and early stage dApps that seek to take full advantage of the stack;

- a blockchain that trades and mints a cryptocurrency (Ammeris Coin [AMRS]) through an automated and fixed monetary policy (AMRS will be used to pay for Ammeris services and deployment on the Platform, including the main-net and stack); and,

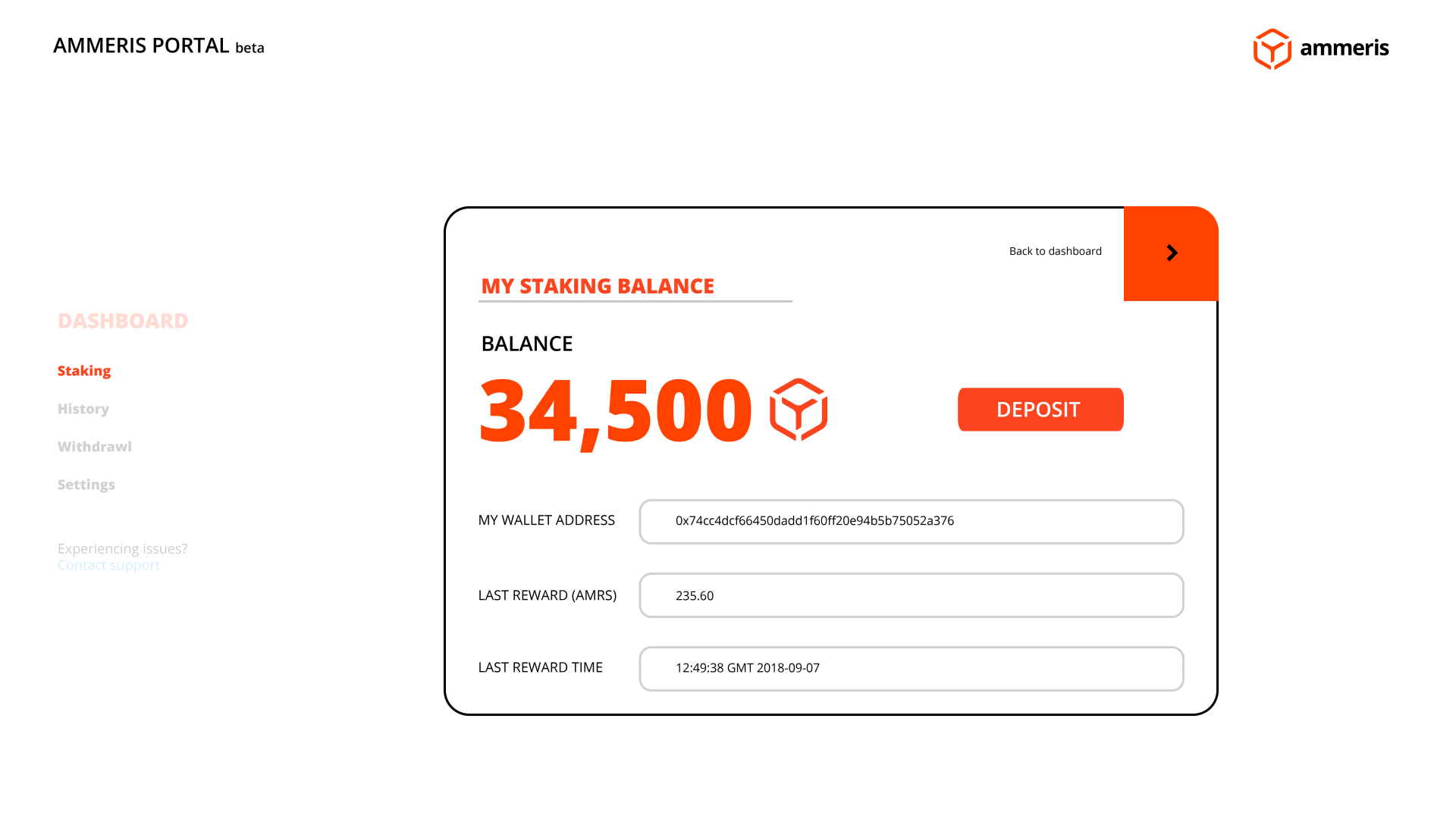

- a platform that rewards stakeholders through the Ammeris Portal, of which allows stakeholders to hedge against the inflation built-in to the system (5% in the first year and decreasing).

Together, the Ammeris Blockchain and stack form a complementary solution. Now, let's dig into some of the details of why PoW works here.

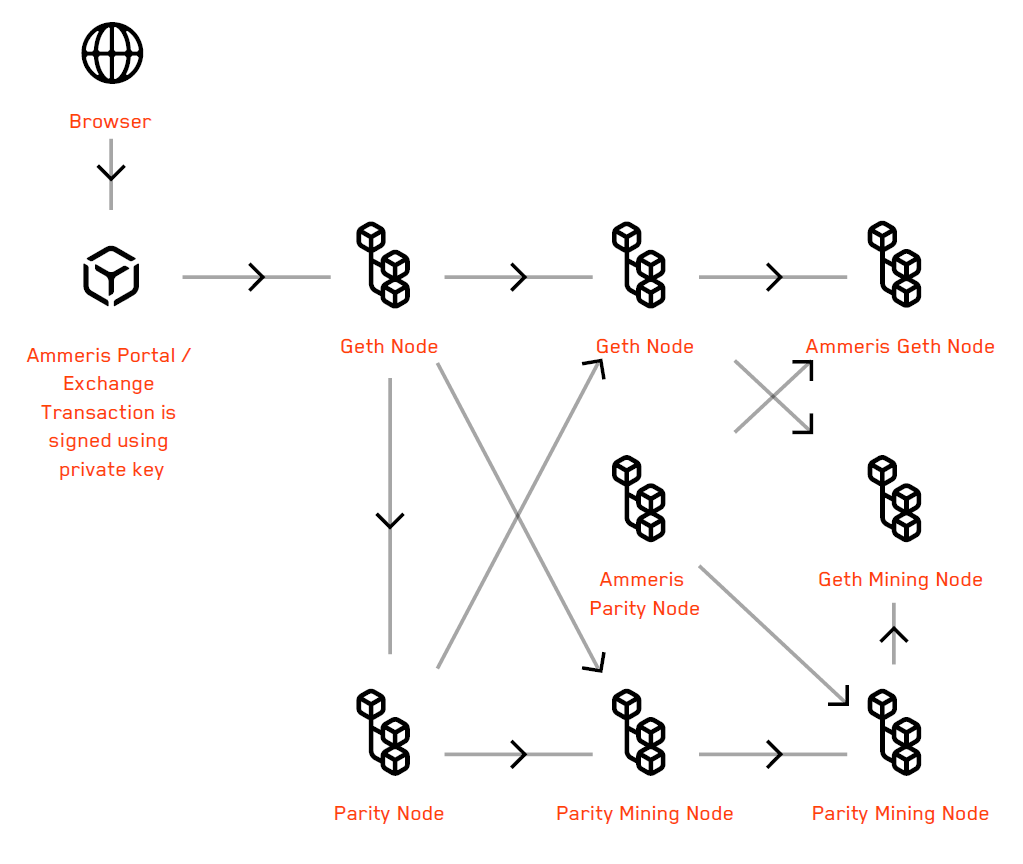

Open for business with the public

One of the major problems facing publicly-accessible ledgers is denial of service attacks. When Nakamoto released the Bitcoin whitepaper back in 2008, PoW was the method of choice to keep spammers away from attacking public networks. Dedicated computing capacity is used to execute a series of “hash” operations until the native algorithm solves a cryptographic puzzle. This way, a degree of work results prior to processing transactions, thus keeping the database from getting overloaded by requests.

For a network that offers a set of development tools including smart contracts, defending from endlessly “looping” code is even more important, and ensuring that computational work takes place will help to defend against debilitating and costly network congestion. In effect, PoW becomes part and parcel of any good public ledger solution. For this reason, PoW was chosen as a hardcoded governance model that ensures that the Ammeris Blockchain serves as a publicly-accessible database for the deployment of smart contracts and early-stage dApps that will eventually take full advantage of the stack. It doesn't boast high performance, because it doesn't need to.A renewables-backed crypto

Of course, few will want to engage in “hash” operations without a reward. On most PoW networks cryptocurrency is used to reward countless, anonymous computers for their work in processing transactions. For the Ammeris Blockchain we are looking to do something different - rather than building a network riddled with inefficiency and massive data redundancy, the Ammeris Blockchain Foundation will be tasked with delegating consensus: First, by engaging in “hash” operations through its own data centers, then eventually handing over the reigns to data centers enrolled in the foundation's Permissioned Node program. Together, we will look to take advantage of PoW’s simple asset creation and validation process, rather than creating a trustless network of redundant agents that may very well be more secure, but would simply not be worth the environmental cost. The PoW process, first and foremost, seeks to deter spamming, and secondly, seeks to reinforce the value composition of the residual crypto asset that is created.

To exemplify, PoW is a validation process whereby energy is consumed to process transactions. Within the context of PoW blockchain, work or the processing of transactions conducted by machines can be understood as the conversion of electricity into cryptocurrency through the block reward process. In other words, the processing of transactions in Ammeris’ case revolves around the “burning” of renewable energy in the form of electricity, which results not in waste but in the creation of a renewables-backed blockchain-native crypto asset: the Ammeris Coin (AMRS).

To do this work, capital is also required to purchase hardware and electricity. Ultimately, Ammeris Coin becomes not only the means through which to incentivize computation to deter spamming, but it also acts as a super-commodity created from renewable energy - in turn providing the mechanism through which the production and storage of green energy takes place in digital form. It forms a degree of sound money backed by energy: a well-defined unit of account that is easy to measure, store, transfer, and difficult to counterfeit. What is more, PoW provides a monetary policy through block rewards that not only ensures predictability of the money supply, but also offsets the natural erosion built into human-operated currencies. All in all, Ammeris looks to limit the environmental hazard often coupled with PoW networks by establishing a permissioned governance model that results in a publicly-accessible ledger and the creation of a crypto asset backed by real work and clean energy.

Staking as a way to incentivize support and distribute inflation

Do the block rewards go to the miners? No. In fact, all the block rewards go to stakeholders through the Ammeris Portal. However, transaction fees in the form of gas will go to the data centers that operate the ledger - we want them to live off transaction fees, not subsidies. We believe this is a better division of incentives between miners and coin holders.

For us, staking Ammeris Coin is an important part of the blockchain's governance model, as each coin translates into an important vote on the Ammeris Blockchain. While this is often a staple of proof-of-stake (PoS) networks, the underlying security function on the ledger remains PoW. Instead, staking empowers coin holders with the ability to offset inflation in the system (think of this as you would if you deposited your money in the bank, and the bank pays you a rate pegged to inflation), and provides them with an opportunity to vote on matters important to the foundation, which is after all, delegating consensus. Call it delegated PoW, if you will.

Ledger immutability is often determined within the blockchain community by the cost of the block reward and the collective computational power or cost of the energy powering the system. Over the past few years however, we have witnessed many networks get taken over by mining cartels, experience significant hashrate volatility or get dominated by ASIC hardware - all of which leads to intense centralization. Therefore we are less inclined to believe in the value of the block reward and the cost of the energy entering the system as a good indicator of security or decentralization - especially when it comes to altcoin networks. Instead we believe a better incentive to grow networks and keep things thriving is to ensure miners or data centers live off transactions fees, not block rewards.

More importantly, trustless models are by and large incompatible with a sustainability agenda and the imposition of any power composition requirements (wind, solar, hydro or fusion). Again, we believe the high cost of securing blockchains through radical decentralization, block reward, and energy heavily outweighs the security benefits or utility that such networks hope to realize. Besides, it remains to be seen if any of these “secure” or “decentralized” networks like Ethereum can become commercially viable. What happens when you remove the block reward subsidy? Will Ethereum miners live off transaction fees? With only 8 dApps with more than 300 users, we don't think so.

Because of these challenges and our focus on sustainability (hence our incentive to use efficient hardware and moderate hashrates) we have introduced a second layer protocol whereby staking sets the necessary incentives to support the network, all while ensuring the risks of forking or project abandonment are minimized. The inflation built into the system is proportionally distributed to incentivize stakeholders (as any good economic system should do) with no minimum stake or requirements. Lastly, the block rewards set by the tokenomics (monetary policy) are fixed, with no room for change to the model - lest confidence is lost and the mission to breakdown boundaries becomes jeopardized.

Various members of Ammeris' team will be taking active positions at the Foundation in the coming months, including serving on the board of directors and its various standing committees. The Foundation will also be starting an initial coin offering (ICO) later this month.

The Foundation is committed to transparency and accountability. To reflect these principles, all committee charters, minutes, policies, and financial audits will be published online at www.ammeris.com/documents .

To learn more about the Foundation, please visit www.ammeris.com/foundation.